Mobile payment apps have largely shaped how consumers transact money, and split payment apps are one of the newest innovations. These apps enable users to split payments between the involved parties, contribute to a more straightforward division of charges, manage group expenses, and even facilitate buy-now-pay-later (BNPL) solutions.

If you’re exploring how to develop a split payments app then this guide will delve into the overall concept, common challenges that may arise during the process, and important factors necessary to achieve a successful user experience.

What is a Split Payments App?

A split payment app is an application that allows users to divide payments between two or more people. Software applications of these technologies have become incorporated into such areas as e-commerce sites, transportation, events, and even food ordering apps. There are many split payment apps available in KSA such as Tabby or Tamara.

They allow users to divide all costs easily and effortlessly, without using cash or engaging in other transactions. Due to the availability and convenience of this flexibility, consumers and businesses have shown a lot of interest in split payment solutions.

Key features of Split Payments App:

Developing a split payments app requires an understanding of the features that require user adoption. Here are some essential ones:

- User Authentication: Safety is always a major concern in any financial application. Ensure that users of the application have access to 2-factor authentication or even biometric identification.

- Seamless Payment Options: Accepts as many forms of payment as possible including credit and or debit cards; wallets; and if possible cryptocurrencies.

- Real-Time Payment Splitting: This enables users to divide the payment in a split second equally among all parties or provide custom payment options for them.

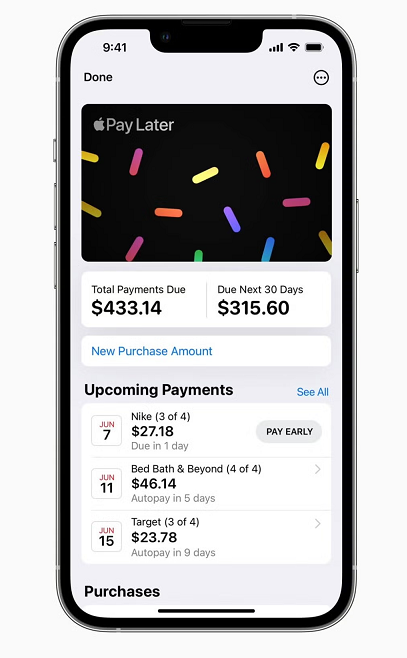

- Expense Tracking: This feature assists users in terms of payments, due dates, and outstanding balances.

- Notifications and Reminders: Sends messages about payments that are due or bills that are unpaid to users.

- User-Friendly Interface: A simpler and easier usability is the major determinant of customer satisfaction.

- Integration with Banking and E-Wallets: Let users connect their bank accounts or wallets to enable direct quick seamless transactions.

Challenges in Creating a Split Payments App

1. Regulatory Compliance and Data Privacy:

Meeting legal and regulatory standards such as the PCI, DSS, and GDPR to protect users’ financial data. It can also help in the process of app development and management by trying to work with different regions’ regulations.

2. Transaction Security:

The security of users’ personal information and their protection against fraud is an enormous concern in mobile app development. Without strict security measures on the line such as end-to-end encryption or even multi-factor authentication, there are risks of data leaks and cyber attacks resulting in loss of customers’ confidential data and other financial losses.

3. Scalability of Payment Infrastructure:

A split payments app may have to process multiple payments at once specifically during the rush hour. Ensuring a realistic backend that can grow with the expectations of the user traffic is essential but can be challenging when using unoptimized technology.

4. User Experience and Interface:

The functionality of a split payment app depends not just on the technical aspects, but on how customers perceive the whole process. Due to the convoluted process of computationally managing payments from parties, creating a simple yet interactive graphical user interface will require design and user testing to avoid misleading inputs/anomalies.

5. Integration with Banks and Financial Services:

The implementation of smooth integration with banks and e-wallets might be quite challenging as every specific institution has different APIs and needs. This is particularly because a firm needs a sturdy and versatile integration framework for these to happen.

6. Fraud Prevention and Detection:

Since using a split payments app is a relatively new concept, there have to be strict systems put in place to track fraudsters. This is a crucial aspect of design and requires heavy capital investment in the possibilities of machine learning or artificial intelligence.

7. Customer Support and Dispute Resolution:

People may require help when it comes to issues such as payment controversy, and account problems among others. It is necessary to develop a sophisticated client service model and, at the same time, introduce chatbots or AI-functionalized customer services.

How to Build a Split Payment Application?

- Conduct Market Research: Before investing in mobile app development for a split payments app, research the market to know competitors and the customer needs. Focus on characteristics that will make an impact on your target users. Research the competition, and pick up on any missing estate your app can satisfy.

- Choose Your Development Framework: Choose the right technology environments that will allow the implementation of a secure and scalable split payments mobile app.

React Native and Flutter are perfect for cross-platform apps, Swift for iOS and Kotlin for Android applications. You will need a robust backend platform to facilitate the transaction processing and data storage, such as Node.js with NoSQL or SQL database is recommended. - User Interface (UI) and User Experience (UX): There is a need to ensure that the design of the application used is friendly to the user. Hire a qualified app development company that can also help in developing a UI/UX design, which is clear, uncluttered, and directed at the selected audience.

- Implement Security Protocols: In financial transactions, security is of great concern. It is advised to get total end-to-end encryption, a secure socket layer (SSL) for transferring data, 2FA, and biometric verification options for protecting the data.

Partnering with a certified app development company helps as you will be able to work hand in hand with them to meet the safety measures of your business. - Payment Gateway Integration: A split payment app heavily relies on the payment processing mechanism that has been defined above. Use a reputable and safe payment gateway such as Stripe, PayPal, or Square.

How Digital Gravity KSA can Help in Creating a Split Payments App:

At Digital Gravity KSA, we are focusing on working on the applications that started from ideas and will become sources of added value soon. Many times, mobile app development creates tremendous integration challenges, which is why our team of experienced developers and designers knows exactly how best to build secure, reliable, and intuitive financial apps.

As a leading mobile app development company in Saudi Arabia, we stay focused on UI/UX design and robust security solutions so that every developed application can act as a viable product in the relevant market.

Conclusion:

As consumers look to simplify the process of handling group expenses and payments, there is an ever-growing need for split payment apps. Nonetheless, it is not easy to develop a split payments app as it needs a smart approach, high protection level, perfect payment connection, and attractive design.

For businesses and entrepreneurs intending to create such a solution, help from a professional app development company such as Digital Gravity KSA, is invaluable. By gaining the help of an experienced team and closely targeting user satisfaction, you can introduce a safe and unique split payments application that will meet the needs of your clients and set you up with a competitive advantage on the market.